This post may be a bit dry for some. I'm going to try and set out the new way of forecasting that I'm applying to my consulting business. The more I think about it the more I'm sure that these principles apply to most freelancers including stand-up comics, graphic designers and the like.

Every successful freelancer struggles with the 'feast or famine' phenomenon whereby you're either too busy to scratch yourself or else you're sitting around waiting for the phone to ring. The problem stems from failing to generate future work whilst you're preoccupied with the challenges of the present. Most of us fall into the dreadful habit of not worrying about the blank page in the diary until that actual day. The oh-so-astute Kate Smurfwaite nailed this with an observation that you often go through periods of always gigging with the same few comics because they emailed with the same promoters s you on the same day three months previously.

I can't remove the need to constantly be prospecting for new business but there are ways to be smart about it. Firstly, focus on the money, not the diary. For fear of an empty diary it's easy to fall into the trap of selling your at a discount. The logic is that it's better to be busy but underpaid than, I dunno, going to the gym and then reading a book.

This diary / money nexus has to be inverted. The question you need to ask is: how much do I want to earn in a year? Work out how much do you need to pay the bills, to add to your savings and still have a little left over to splash around to prove to yourself and the world that this self-employment malarkey is working out.

Let's call that 'annual earnings' figure A

Have a good hard look at it. If it doesn't look a little daunting then you probably haven't got the maths right. Once you're happy, divide it by four as we're going to work in quarters.

Let's call that 'quarterly earnings' figure Q

Now rather than one big problem (

A) you've got four smaller problems but they won't seem to be problems of equal size. If we say we're going to start this new regimen on April Fools Day then the challenge of earning

Q for April-May-June probably seems much more daunting than for January-February-March. Or maybe your diary's looking good up until summer and you've got less of a handle on July-August-September. Either way,

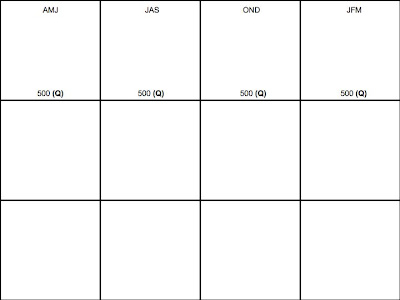

the psychological challenges represented by Q fluctuate over time.From here in on you'll need pen and paper or (better still) a spreadsheet. Create four columns, one for each quarter with three rows. Write Q at the bottom of the first row as per below

Now get your diary and enter every

definite job in the appropriate quarter. Only include those where you are 100% sure that your services will be needed and that you will be paid.

Let's call these 'definite earnings' D

List the details of

D in the top row of appropriate quarter and subtract that from

Q. Call that new figure

QaThis example roughly follows the pattern that my business follows: few clients book me a long way in advance so I have to be comfortable with a 3-6 month horizon. I know I should be worried that the end of the year and early 2012 are looking thin but I also need to know what to do with that worry.

Go back to your diary. Now list every probable job by quarter. Define 'probable' as anything where there's a better than 2 in 3 chance of your services will be needed and that you will be paid.

Let's call these 'probable earnings' P

List the details of

P in the top row of appropriate quarter. Now divide P by 1.5 and subtract that from Qa to get Qb

Why 1.5? Because we think there's about a 2 in 3 chance of the job coming off. And look what I've learned; I'm probably going to miss my budget (

Q) for April-May-June by 17 but I'm more than fine for July-August-September. More importantly for the period between October and March I still have a lot of work to do. Even though I

might bill another 360 in October-December, which would get me to 510, the jobs aren't booked yet so I'd be a fool to bank on them. And I still have plenty of work to do for the start of 2012.

We have to make up the difference in the bottom row. This is where the diary is of less use than the old the contact list, that stack of business cards and the guy who said to give him a call some time. We're deep in maybeland.

So let's call these 'maybe earnings' M

There are only two places that these earnings can conceivably come from:-

- Finding new clients (Mnc), or

- Selling new products (Mnp) to old clients

I've had my UK business for almost six years, so I have enough data to know that my average time from first meeting with a client to actually delivering a project is 8.67 months. I've never been able to reduce this. I now accept it as a fact of my working life. So even if I met a potential client today I can't realistically bank on anything (

Mnc) before January.

Another problem is I'm not especially good at putting time aside for new product development (Mnp). Almost all of my innovations have emerged as solutions to problems articulated by clients and I'm actually quite crap at building the thing that meets the unrecognised need. But I do have a few ideas that have worked in one market but have yet to be taken up in others so there's hope for me yet.

I guess we'd better input M into our spreadsheet

This bottom row always has a fantasy element about it, however, the rule is

you must keep the Qc fantasy to the right hand side of the page. If I could realistically anticipate any new business in the next six months then it should appear in the middle row (

Qb). If I need it to happen later in the year it's a task, needing it tomorrow makes it a prayer.

In keeping with my 8.67 month average I've assumed I'll get no new clients (Mnc) before next January. This means that all of my October-December earnings have to come from existing clients (Mnp).

To temper the fantasy just a little you'll notice that I reckon there's only about a 1 in 3 chance of any Qc earnings actually coming off; remember that we're selling either something that doesn't yet exist or to someone we haven't met. So we have to be able to identify three times as many Qc opportunities.

Summary

My imaginary business might just survive the next twelve months. Well done me. But for that to happen I've got to find new things to sell to my existing clients as well as speaking to new ones. I knew that already. The nasty truth I've was avoiding was that both these tasks have to happen now.

Variations

There are a few obvious variations to this basic model that will make it more applicable. For example, I've assumed that the demand for my stuff is constant throughout the year (500 / quarter). If your business dries up in the summer then you the initial Q figure for that quarter and compensate with higher targets over the rest of the year. Anyone contemplating the Edinburgh Fringe may well have a negative figure for July-August-September.

I've also gone for conversion rates (1.5 and 3) that are a realistic reflection of the way my industry operates but may be questionable elsewhere.

In Conclusion

As I said at the beginning this is a new technique for me and I apologise if in my excitement I've overcomplicated it. Like many good ideas it seems to clarify something that I've long known but never articulated. I like knowing where I need to focus my attention. I like that it shines a harsh light on the naive expectation that 'somewhere, someone unknown to me is about to come to my rescue'.

I like that if I can see a feast on the horizon then I can decide that next week isn't a famine but a chance to finish that book.